SM Entertainment has moved to provisionally seize assets belonging to EXO-CBX (Chen, Baekhyun, and Xiumin), totaling approximately ₩2.6 billion. As reported by Biz Hankook on Wednesday, February 11, 2026, the two-day action in early February stems from a dispute over a 10% revenue share for members’ individual activities after leaving the agency. It was formalized in a written agreement signed between 2023 and 2024.

That said, this case goes beyond unpaid earnings and offers a closer look at how contract enforcement operates as a fundamental business mechanism in the K-pop industry.

Not a Full Exit: How CBX’s Deal Created “Partial Independence”

In 2023, a conflict between CBX (Chen, Baekhyun, and Xiumin) and SM Entertainment stemmed from allegations of a lack of transparency regarding their contracts and revenue distribution. Through their new management agency, INB100, the three sued SM, challenging the company’s unfair exclusive-contract system.

However, the end result was not a complete severance of ties. Exclusive contracts in K-pop represent a significant commitment for both artists and agencies. These contracts involve years of hard work, training, and financial investment. Therefore, disputes like this cannot be resolved lightly.

On June 18, 2023, the two parties signed a written agreement paving the way for a new working model. Why did they choose this path? Because terminating the contracts immediately without negotiation could have caused chaos, both legally and financially. Rather than simply leaving SM, the three and SM reached an agreement that allowed stability for both parties.

The bottom line can be summarized in a few key points:

- Chen, Baekhyun, and Xiumin’s individual activities are managed by INB100.

- SM no longer handles the day-to-day management of their solo activities.

- However, 10% of the revenue from their individual activities is retained by SM.

- The provision was further strengthened in the 2023–2024 agreement.

This model creates what can be called “partial independence”, a form of freedom that is limited and structured.

Why Enforcement Matters in K-Pop

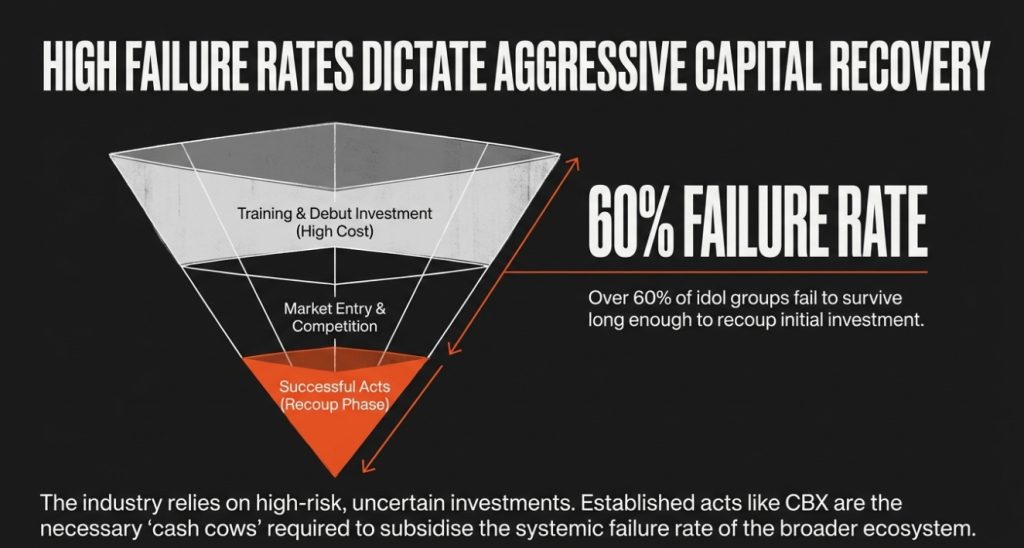

Structurally, the K-pop industry relies on uncertain investments. Research shows that over 60% of idol groups fail to survive long enough to recoup the funds companies invest in training and debuts.

In such situations, agencies focus more on securing capital than on immediate profit sharing. Although idols are a major source of revenue through various campaigns, profit-sharing schemes are often structured so that companies can recoup their capital before the artists receive a larger share.

Furthermore, most industry data also shows that the portion of profits agencies take from idol activities has increased sharply over the past ten years—from around 12% in 2010 to 45% in 2023. It illustrates how companies are tightening financial controls, and artists’ bargaining power increases.

It’s worth noting, however, that SM’s seizure is temporary, intended to freeze assets to prevent them from being transferred or generating profits during the legal process. This measure is generally taken when there is concern that financial obligations cannot be met if the assets are transferred first. Therefore, it aims to maintain the integrity of the revenue sharing system—a form of financial discipline and risk management, not simply a repressive measure.

Power Dynamics Between Agencies and Artists

The South Korean entertainment industry has long been dominated by agencies that maintain a strong grip on artists through long-term contracts and manage the group’s overall image. Major conflicts like TVXQ’s feud with SM (which gave rise to JYJ) and recent issues involving groups like NewJeans demonstrate that tensions over profit-sharing and managerial control have long existed.

What’s different now is the artists’ bargaining power.

Both older and newer generations of artists are now more willing to challenge the terms of their contracts. However, ownership of the group’s name and certain economic rights typically remains with the company.

In EXO’s case, although Chen, Baekhyun, and Xiumin operate independently through INB100, legal authority over financial agreements remains with SM—a reminder that, in K-pop, operational independence does not always translate into complete financial autonomy.

Independence Within Boundaries

Since the dawn of the Hallyu wave, exclusive contracts have been the foundation of the K-pop industry, binding artists and agencies to long-term commitments that involve significant investment and high risk. The seizure of Chen, Baekhyun, and Xiumin’s assets by SM Entertainment demonstrates that even with legal instruments, there are real consequences. Likewise, their “partial independence” model reveals that leaving an agency doesn’t always mean complete financial freedom. Ultimately, SM’s move signals that, in the K-pop business, revenue-sharing agreements will be upheld, and any exit will carry economic responsibility.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.