In the South Korean entertainment industry, a growing number of prominent actors and idols are launching independent “one-person” agencies to gain creative freedom and manage their own professional growth.

While pioneers like Lee Byung-hun and Hyun Bin successfully expanded their ventures into major talent hubs, recent stars such as Cha Eun-woo and Kim Seon-ho have faced intense scrutiny regarding the financial and legal transparency of these entities.

So, can an artist manage their career through a one-person company without landing in legal hot water? The answer is “yes,” with some caveats: the entity has clear substance and follows strict registration and operational rules, like other major entertainment agencies.

In 2025–2026, a one-person agency is not only about freedom but also about the business substance and the correct tax assessment. Consequently, the Ministry of Culture, Sports, and Tourism is now pushing for stricter regulatory compliance to ensure a more ethical and lawful management environment.

South Korea’s One-Person Agency Boom: Independence, Registration, and Risk

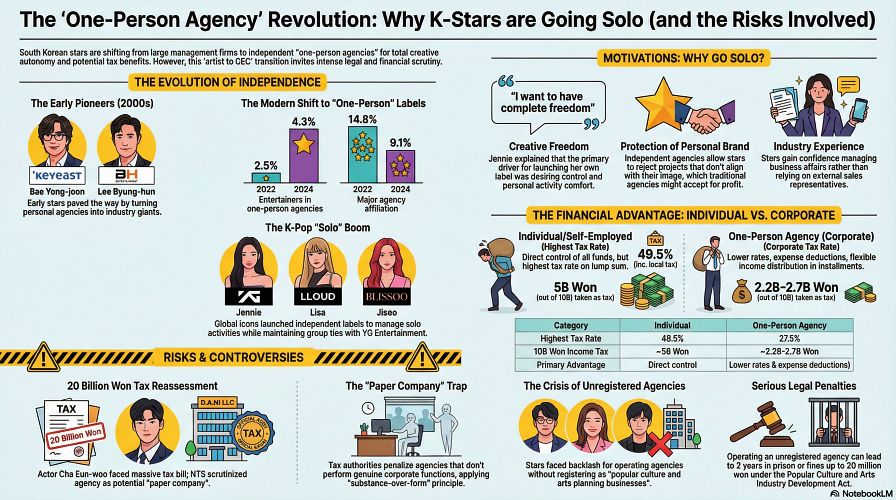

The entertainment world is changing fast. Korea’s biggest stars are moving away from major labels to run their own companies. The number of entertainers in one-person agencies nearly doubled between 2022 and 2024. Meanwhile, major labels are losing their grip on top talent.

This trend highlights a major shift in business and entertainment. These one-person agencies in Korea not only offer greater creative freedom and higher profits but also carry immense financial stakes.

A one-person agency does not mean a one-artist entertainment agency. It usually refers to a one-person corporation (sometimes called a private company). It is a company owned and controlled by the artist or a family-linked individual.

For a one-person agency in the entertainment business, individuals should apply for planning business under the Ministry of Culture, Sports and Tourism (MCST) of South Korea.

Registration and “substance” are linked, but they are not the same.

- MCST asks: “Are you registered and allowed to operate?”

- Tax authorities ask: “Did this company do real work for a real business purpose—beyond tax benefits?”

Why Stars Are Breaking Away from Major Labels

In South Korea, many artists set up “one-man agencies” to control revenues, deals, schedules, and branding. Below is the table that shows the contrasts between the traditional agency and the independent label:

| Dimension | Legacy Management | Independent Label |

|---|---|---|

| Creative and Image Control | Agency-led. Company goals and stable portfolios can outweigh the artist’s personal preferences. | Talent-led. Full control over projects, image direction, and scheduling. |

| Revenue and Tax Distribution | Revenue is split by contract. The artist’s share can face high personal income tax (up to 49.5%). | Income is handled through a corporate entity, which may fall under lower corporate tax brackets. |

| Operational Risk | Lower for the artist. Big agencies handle legal, PR, and admin work. | Higher. Without strong systems, one scandal can damage the entire company. |

The primary reasons for this shift include creative freedom, image management, financial benefits, and tax management.

Historically, this evolution began with early pioneers such as Bae Yong-joon (BOF/Keyeast) and Lee Byung-hun (BH Entertainment). Today, the movement has achieved global scale through modern icons like BLACKPINK’s Jennie (Odd Atelier), Lisa (LLOUD), and Jisoo (BLISSOO).

In an interview with Vogue Magazine, Jennie said about her one-person agency:

“As someone whose every move is exposed to the public, it’s my role to show a new side of me each time. I’m always wondering, “What new aspect of me can I reveal this time?” I wanted to create a space where I could fully immerse myself in exploring such ideas.”

Meanwhile, Jun Ji-hyun noted upon launching her independent label, Peach Company,

“After many years as an actress, I needed time to reflect and explore new directions. Peach is a choice that captures my current self and a starting point to focus on more essential things.”

The Tax Gap

The primary financial driver for incorporation is the massive gap between South Korea’s 49.5% personal income tax rate and the 24% corporate tax rate.

While “tax saving” is legal, the Lee Jae Myung government has empowered the National Tax Service to crack down on structures that cross the line into evasion.

Citing from Chosun, Kim Sang-bong, a professor of economics at Hansung University, said

“A one-person agency itself is not illegal, but if a company was created in name only simply to avoid taxes, it becomes subject to assessment.”

Registration vs. Substance of One-Person Agencies in Korea

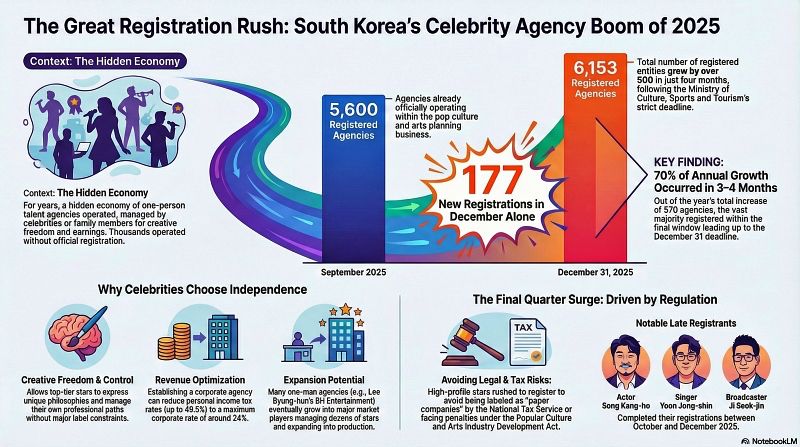

One-person companies are becoming common across the entertainment industry. Chosun reported that in the 2025 Survey on the Popular Culture and Arts Industry by the Ministry of Culture, Sports and Tourism and the Korea Creative Content Agency, the proportion of entertainers connected with independent labels rose from 2.5% in 2022 to 4.1% in 2023 and 4.3% in 2024.

According to The Asia Business Daily, the Ministry of Culture, Sports and Tourism (MCST) admitted its lack of oversight of unregistered entertainment agencies and has announced a comprehensive review of the system.

In 2025–2026, regulators increased checks to ensure companies were properly registered under the Popular Culture and Arts Industry Development Act and were operating within legal limits.

Under the Popular Culture and Arts Industry Development Act, any business that provides management, training, or casting services must register with MCST as a “Popular Culture and Arts Planning Business” to operate legally in South Korea.

The Compliance Crisis: The Sudden Rush for Legal Registration

The Asia Business Daily’s report also found that illegal business practices triggered a massive regulatory shockwave. Faced with a Ministry of Culture, Sports and Tourism deadline of December 31, 2025, hundreds of celebrity agencies rushed to register to avoid a total operational shutdown.

The data reveals:

- By the end of 2025, official registrations jumped to 6,153 agencies, an increase of 500 in just four months.

- In December 2025 alone, 177 agencies registered, accounting for nearly 70% of the year’s total agency growth.

- High-profile holdouts who belatedly filed include Song Kangho, Yoon Jongshin, and Lee Dongguk (Daebak Dreams).

Why “Substance” Decides Everything

A one-person agency can be legitimate as long as it has “substance.” In other words, it runs real business activity. Concerns arise when authorities discover that the company exists only on paper and has no operational facts.

What “Substance” Tends to Look Like

- Clear Contracts: Well-defined agreements that outline real services and deliverables.

- Evidence of Operations: Signs of ongoing business activities and administrative work.

- Business Expenses: Costs linked to actual business activities rather than personal expenses.

- Consistent Bookkeeping: Reliable financial records and documentation.

- Separation of Expenses: A clear difference between personal and corporate spending.

What Often Triggers Questions

These are patterns, not evidence, that often prompt authorities to conduct further investigations.

- Personal Spending: Corporate funds used for personal expenses without a clear business purpose.

- Insufficient Documentation: Corporate cards, vehicles, or reimbursements are lacking proper records.

- Unexplained Salaries: Paying family members without defined roles or work responsibilities.

- Minimal Activity: Large sums of income passing through a company that appears to have very little business activity.

The “40-Hour” Loophole

The Popular Culture and Arts Industry Development Act intended to professionalize the sector. Still, the Ministry’s “40-hour training” alternative to the two-year experience requirement has created a loophole for “Home-Based Agencies.”

These entities often lack professional management, as any family member can become a corporate representative after a week of unverified training.

Bae Seonghee of the National Assembly Research Service warns that this “formalized” system prioritizes registration over actual capability, weakening artist protections. Tellingly, since this system’s inception, not a single fine has been imposed for failing the training, highlighting a lack of direct enforcement authority.

The Fallout: Celebrity Case Studies

Several artists have been named in reporting tied to alleged unregistered operations, with cases moving to referral stages.

- Sung Si-kyung (SK Jaewon): JoongAng Daily reported that his agency operated for years without proper registration, raising the possibility of criminal charges under the registration rule.

- Ock Joo-hyun: JoongAng Daily reported that her agencies were found to be unregistered, prompting an apology/reporting, and follow-up compliance discussions.

- Lee Ha-nee (Hope Project)- 6 billion KRW: multiple outlets reported that she and her husband were referred to prosecutors for operating an unregistered agency. At the same time, her team said registration was completed (a certificate was received in late 2025).

- CL (Very Cherry): reported referral to prosecutors tied to operating an agency without required registration for years.

- Lee Hi (8O8 Hi Recordings) – 3 billion KRW: MK reported that her one-person agency had operated unregistered for over 5 years. The agency stated that registration was completed belatedly.

- Cha Eun Woo: As of February 2026, actor and ASTRO member Cha Eun-woo is under investigation by South Korea’s National Tax Service (NTS) regarding alleged tax evasion, with a 20 billion KRW ($13.7 million – $15 million) penalty.

- Kim Seon Ho: Actor Kim Seon-ho faced scrutiny over “home-based” corporations in which parents serve as board members to justify corporate card use, vehicle expenses, and inflated labor costs.

Critical Compliance Alert

The South Korean government has ended its period of administrative leniency for unregistered independent entertainment agencies. Failure to register as a “popular culture and arts planning business” by the December 31 deadline carries severe legal and financial consequences.

1. Criminal and Administrative Penalties

Under the Popular Culture and Arts Industry Development Act, non-compliant entities face:

• Imprisonment & Fines: Up to two years in prison or fines of up to 20 million KRW.

• Investigative Referrals: The Ministry of Culture, Sports and Tourism will initiate prosecutions immediately following the deadline. High-profile figures, including rapper CL and the CEOs of agencies for Gang Dong-won and Lee Hi, have already been referred to prosecutors.

2. Industry Crackdown

The Korea Entertainment Management Association has adopted a “no leniency” policy. The association is actively filing formal petitions for strict punishment, arguing that operating without registration, even if corrected in the future, disrupts industry order and violates the law.

3. Tax and Business Risks

Operating without legal registration significantly increases exposure during National Tax Service (NTS) audits:

• “Paper Company” Classification: Unregistered status allows tax authorities to reclassify agencies as illegitimate entities.

• Massive Financial Penalties: This can trigger significant tax reassessments and additional penalties of up to 40% for underreporting. (e.g., the recent 14 million KRW case involving Cha Eun-woo).

For independent agencies, the December 31 deadline was a hard pivot toward corporate accountability. Missing this requirement risks criminal records, tax penalties, and irreparable brand damage.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.