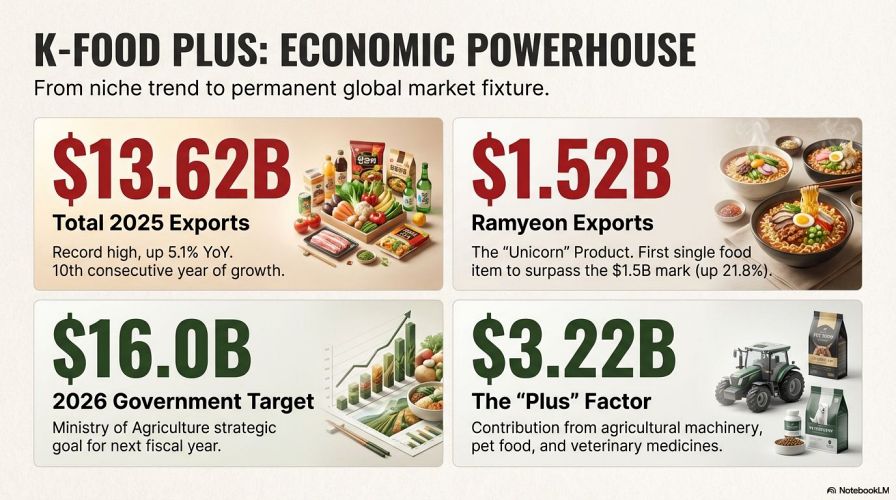

In 2025, South Korean food and agricultural exports (“K-Food Plus“) reached a record high of $13.62 billion, up 5.1% year over year. This growth is fueled by the record-breaking success of Korean instant noodles, ramyeon, which surpassed $1.5 billion in annual exports for the first time. Following the viral popularity of the noodle dish Jjapaguri, featured in the 2019 Oscar-winning film “Parasite,” the 2025 Netflix sensation “KPop Demon Hunters” has transcended entertainment to become a powerful marketing engine for Korean cuisine, particularly Ramyeon. Driven by media placements in Netflix hits and aggressive localization in the US, Europe, and Gulf countries, the sector offers a blueprint for how “soft power” can generate tangible economic value.

From Screen to Table: The $13 Billion Global Rise of K-Food

Watching Korean content has now led to eating Korean food worldwide, which is also influencing grocery shopping lists. This trend is transforming the culinary specialty into a global force worth billions of dollars by 2025.

Korean content is acting as a marketing and sales force for international trade. This trend also proves that what audiences watch determines what the world buys.

The Netflix Catalyst: How Animation Feeds Global Markets

K-content now drives global food logistics and consumption habits. The 2025 Netflix animated film “KPop Demon Hunters” boosted this trend.

The film, which follows the K-pop trio HUNTR/X (Rumi, Mia, Zoey) as secret demon slayers, displays the characters eating ramyeon and whole gimbap rolls. These scenes sparked viral social media challenges and immediate product demand.

Nongshim partnered with Netflix to capitalize on the momentum, releasing limited-edition products in North America and Europe. The collaboration converted cultural hype into measurable export revenue.

“Many people associate our products with the scenes in K-Pop Demon Hunters where they eat ramyeon. With this collaboration as a catalyst, we want to achieve record-breaking export sales.”

Representative from Nongshim, regarding their partnership with Netflix.

The impact extended beyond branding. Producers adjusted supply lines to meet increased global demand.

The Instant Icons: Ramyeon and Jjapaguri

The Oscar-winning film “Parasite” and the 2025 Netflix sensation “KPop Demon Hunters” have elevated these pantry staples to cinematic stardom.

“KPop Demon Hunters” features characters frequenting noodle shops that display the Hanja character Shin (辛)—which literally translates to “spicy”—on their packaging.

This is a direct nod to real-world brands like Nongshim, which have even partnered with Netflix to release limited-edition packaging featuring characters from the show. In the same series, characters are frequently seen snacking on Saeukkang (Shrimp Snacks), a salty, iconic snack that has seen a massive surge in export demand.

| Brand Name | Key Media Feature | Distinguishing Characteristic |

|---|---|---|

| Samyang Buldak | Global “Mukbang” social media trends | Driven by superior marketing and extreme spice levels; expanding with a new plant in China to meet demand. |

| Shin Ramyun | “KPop Demon Hunters” (Netflix) | Features the “Shin” (辛) character meaning spicy; promoted with the global slogan “Spicy Happiness.” |

| Jin Ramyeon | Ramyeon powers K-food exports | A steady staple produced by Ottogi, which is expanding its global footprint with a California plant by 2027. |

| Jjapaguri (Mix) | “Parasite” | A creative fusion of black bean noodles (Chapagetti) and spicy seafood noodles (Neoguri); Nongshim is now building an export-only factory in Busan. |

The Ramyeon Revolution: 2025 Data and Market Share

Export Statistics for 2025

The intersection of media and food delivered record financial results in 2025.

| Category | Export Value (USD) | Growth Rate (YoY) |

|---|---|---|

| Total K-Food+ | $13.62 Billion (Record high). | +5.1% |

| Processed Food Products | $10.41 Billion | +4.3% |

| Agricultural Industries (includes machinery, fertilizer, and seeds). | $3.22 Billion | +8.0% |

| Ramyeon (Instant Noodles) | $1.52 Billion (up 21.8% year-over-year). | +21.8% |

Beyond noodles, diversification strengthened the sector:

- Sauces: $412 million

- K-Ice Cream: Over $100 million

- Farm machinery: $1.35 billion (up 10.8%)

The Billion-Dollar Noodle: Analyzing the Global Noodle War

Industrial Adaptation and Localization Strategies

To sustain Hallyu-driven demand, manufacturers are scaling operations and moving beyond domestic production to localized global hubs. This shift minimizes supply chain disruptions and mitigates the impact of trade tariffs.

| Region | 2025 Export Value | Growth Catalyst | Primary Driver |

|---|---|---|---|

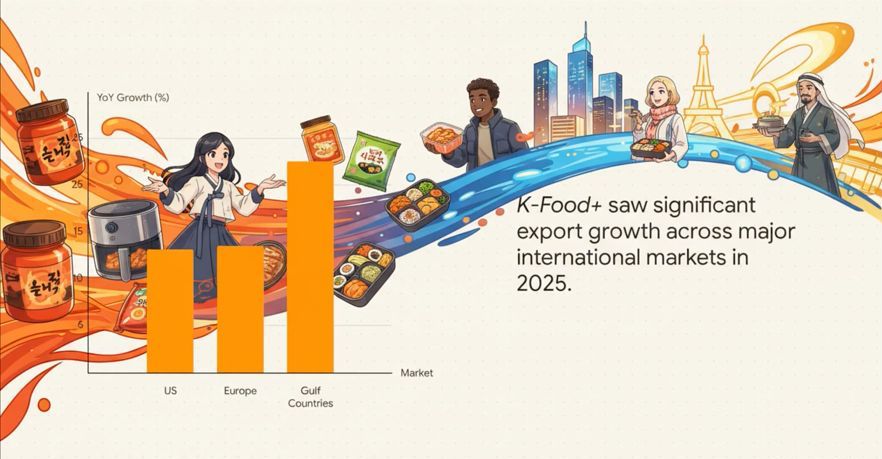

| United States | $1.8 Billion (up 13.2%) | Localized Production | Ramyeon, Sauces, Agri-Machinery |

| China | $1.59 Billion | Strategic Manufacturing | Samyang/Nongshim Processed Goods |

| Europe | $774 Million (up 13.6%) | Health & Wellness Trends | Kimchi, Rice-based Foods, Tech |

| Gulf Countries | $412 Million (up 22.6%) | Halal Certification | Spicy Ramyeon, Halal-certified Snacks |

Key Industry Players and Strategic Initiatives

Ramyeon is the addictive food of Korean cuisine for international investors and consumers. It is affordable, practical, and easy to distribute. Nongshim, Samyang Foods, and Otoki lead the market. They are shifting from domestic-focused production to global-first strategies.

Nongshim

- Market Share: Nongshim accounts for approximately 53–54% of total Korean instant noodle sales.

- Expansion: Operating plants in the U.S. and China, and constructing an export-only factory in Busan to manage global surges.

- Media Collaboration: Partnered with Netflix for the K-Pop Demon Hunters (HUNTR/X) film, featuring character-themed packaging for global markets (North America, Europe, and Korea).

Samyang Food

- Buldak Brand: Leveraged the “mukbang” (eating broadcast) trend and social media spice challenges to achieve global dominance.

- Infrastructure: Constructing its first overseas plant in China. More than 70% of the firm’s total revenue is now derived from exports.

Dongwon F&B

- Product Focus: Dominates the convenience market with 3-minute instant Topokki (rice cakes).

- Strategy: Targeting global retailers like Amazon, Walmart, and Costco to provide “authentic street food” flavors to home cooks.

Otoki

- Infrastructure: Advancing its California production facility (target 2027) after establishing its U.S. subsidiary.

Emerging Culinary and Cultural Trends

Institutional Recognition

Linguistic and institutional milestones mark the global integration of K-Food:

- Oxford English Dictionary (OED): Recently added “ramyeon” and “mukbang” as official entries.

- UNESCO: Korean bean paste (Jang) has been listed as a UNESCO Heritage item, increasing the prestige of traditional Hansik.

Product Innovation and Adaptation

- Health and Lifestyle: Rise of vegan, low-fat, and zero-sugar variations in ice cream and snacks.

- Adaptation and Localization Strategy:

- Russia: The brand “Chiko” adapted dishes to be less spicy but more visually bright to suit local preferences.

- Gulf Countries: Strategic focus on Halal-certified meats (e.g., Mom’s Touch chicken burgers) to capture the Islamic market.

- Fusion Cooking: Consumer-led innovations such as kimchi grilled cheese, Topokki mac & cheese, and Korean-style tacos.

The “Swicy” and “Matcha” Trends

Korean snack brands are highly elastic, quickly adapting to global trends. Brands have converted original products into “matcha” variants to capture international “hype,” while the “swicy” (sweet-and-spicy) flavor profile of Korean sauces has reached $412 million in exports.

Beyond the Trend: 2026 Sustainability of the K-Food Model

“Even in a challenging trade environment, we delivered a record result on the back of strong global interest in K-food and the competitiveness of K-Food+ products. The government has set a $16 billion export target for K-Food+ in 2026.”

Minister Song Mi-ryung, Ministry of Agriculture, Food and Rural Affairs.

The South Korean Ministry of Agriculture, Food and Rural Affairs has set an ambitious $16 billion export target for 2026. Future growth is expected to stem from:

1. Variety Show Influence: New series like “Please Take Care of My Refrigerator 2” and “Culinary Class Wars 2” are expected to drive interest in high-end Korean gastronomy.

2. Diversification of Staple Foods: Moving beyond noodles and BBQ toward hearty “gukbap” (soup with rice) and specialty bakery items.

3. Technological Integration: Increased exports of agricultural machinery, fertilizers, and “farm know-how” as part of the broader K-Food+ initiative.

Final Thoughts

The K-Food surge reflects a structural shift, not a temporary spike. Entertainment now shapes global demand patterns. Screen time converts into export volume, and cultural visibility translates into industrial expansion.

The connection between media and manufacturing has become a durable business model, permanently reshaping global trade flows.

By blending storytelling with flavor, Korea has successfully transformed its cuisine from a niche interest into a permanent player in the global culinary market, ensuring its influence will continue to expand from our screens to our dinner tables for years to come.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.