Did comebacks evolve beyond release schedules into a global “visibility growth strategy,” or has that model been completely replaced by a more sustainable K-pop business strategy after comebacks?

If you sat with the schedule of a K-pop group, you probably have realized that for decades, Korean entertainment relied on comeback and chart results for promotions. What felt like a great decision in the industry fell apart. What tasted sweet has finally rotted in the mouths of the Korean entertainment agencies. The traditional system has begun to stagnate, pushing agencies to rethink the K-pop agency strategy that governs long-term success.

BIGBANG’s legacy in K-pop marked the first major disruption of this tradition. Rather than disappearing between releases, the group redefined momentum by maintaining constant cultural presence. Their calendars were filled year-round, positioning members as individual cultural figures and laying the foundation for a modern K-pop industry business strategy centered on visibility rather than frequency.

Come and follow along to explore the secrets that the Korean entertainment industry has been working on below the surface.

From Idol to Cultural Asset: Where the Global Visibility Began

In the early days, the Korean entertainment agencies rarely operated like YG Entertainment. They established the rules to teach the other first- and second-generation groups who disappeared after comebacks, entered long-gone hiatuses, and found global visibility speaks more than just lifeless, long-gone promotions, expanding the K-pop industry. The K-pop agency strategy with sustained global visibility—not short-term chart performance—was the key to longevity and K-pop global expansion.

G-Dragon’s rise is a correction to the definition of momentum in K-pop. As BIGBANG’s leader and creative core, he quickly became more than a chart-topping idol. By launching his lifestyle brand PEACEMINUSONE, G-Dragon positioned himself beyond music. He led global sell-out collaborations with Nike and later expanded his international visibility through USC Annenberg courses and the ZO&FRIENDS x Rom&nd makeup collection. This shift exemplifies a refined K-pop business strategy after comebacks, where fan engagement and brand relevance sustain long-term growth.

The Business Model: The Pioneer Meets The Inheritor

If YG Entertainment had BIGBANG as the pioneer of this new generation, then BLACKPINK is the inheritor of this model.

Expanding and dividing the strategy into smaller parts, rather than having just one individual take the lead, YG Entertainment expanded their K-pop industry business strategy. They stepped into the gloves that mold BLACKPINK as a whole and sprinkled them out for greater media exposure. Each member took on their individual partnerships with well-known global brands:

- Jennie is a CHANEL ambassador.

- Lisa as CELINE and BVLGARI ambassador.

- Rosé as Saint Laurent and Tiffany & Co. ambassador.

- Jisoo as a Dior ambassador.

From a business perspective, this was transformative. Stripping away the release frequency by increasing global influence. What’s left is an elevated comeback rather than a distinct survival mechanism for current and ongoing generations of K-pop groups. They return when market demand is primed and perform as monetizable visibility through various social media platforms, making it easier for fans to follow.

By the late 2010s, this model was no longer an exception–it was a complete business system.

Actors and Fan Meetings Expanded Calendar

Today, the same framework extends beyond idol groups to anything that begins with the prefix idol. They now operate within the same K-pop industry business strategy.

Cha Eun-woo has post-project periods that serve as windows for global expansion—rolling out with international fan meetings, large-scale public appearances, and global brand campaigns while keeping the buzz going, as seen in ‘The Royal’ fan meeting in July. A way for him to say farewell before his military enlistment—gaining as much emotional engagement as possible to prepare for the long break.

The nooks and crannies of the calendar are filled with work and events. It’s a standardized K-pop agency strategy.

Continuous Visibility Works in a Global Market

Agencies know that if visibility skyrockets, the industry will follow suit. What makes this model effective isn’t what they force into it; it’s what is rooted in the Millennials, and becomes what global audiences consume today.

Below are the statistics charts that show the increase in money and views:

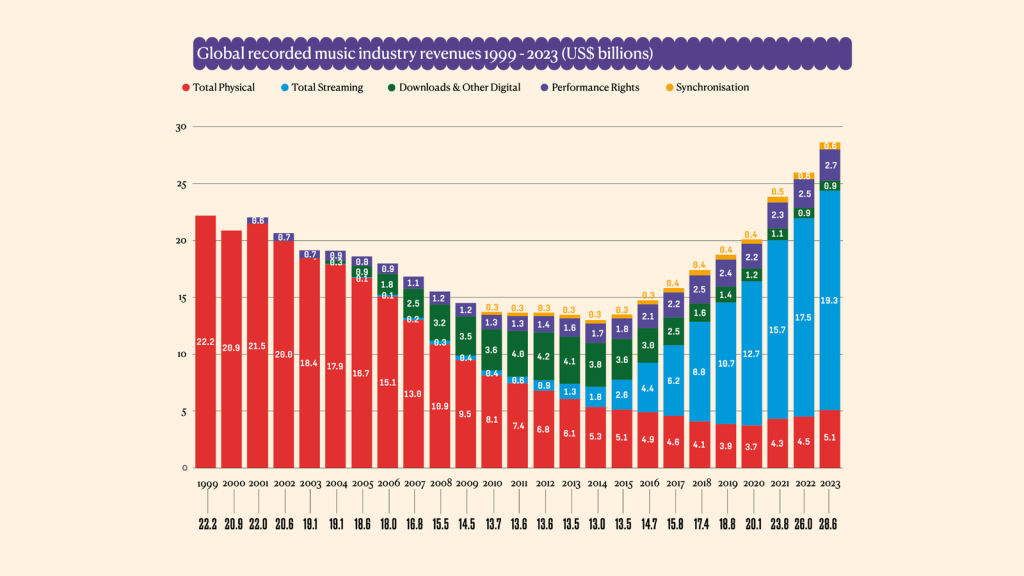

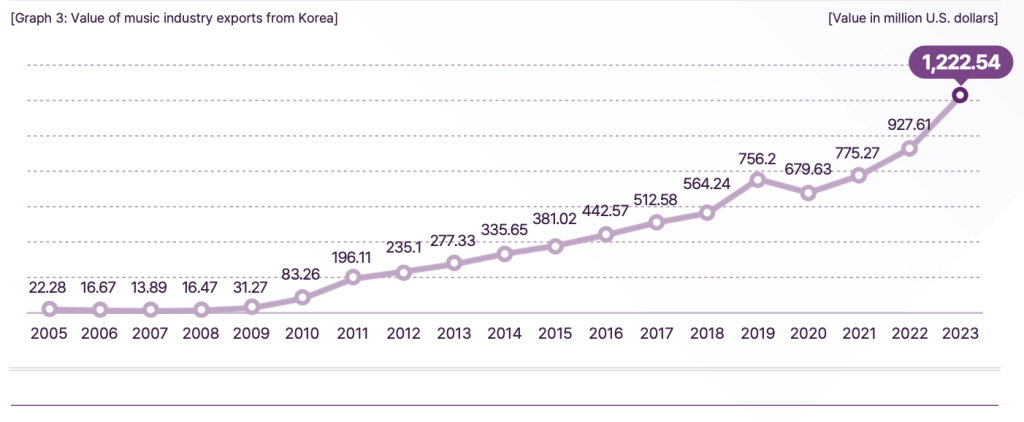

In 2023, the International Federation of the Phonographic Industry (IFPI) global recorded music revenue surpassed USD $28 billion, while Korean music exports of the Korea Creative Content Agency (KOCCA) show that, due to the increase in popularity in K-pop, it exceeded approximately USD $1 billion, reflecting the scale at which global attention now converts into economic opportunity. Seems like the agency companies have proven their point, pushing back on the traditions that they used to hold tight to.

The Next Phase: New Generation Business Growth

A comeback isn’t just an essential part of each group; it can’t be taken out of the promotion equation. In many ways, they are known for their early growth and for maintaining the purest connection between artists and fans. But the K-pop business model does not stop there.

From BIGBANG’s legacy in K-pop to BLACKPINK’s global systemization, Korean entertainment has perfected a K-pop industry business strategy that thrives beyond release cycles. This evolution signals a future where visibility, cultural relevance, and global positioning drive the next era of the industry—well beyond the comeback stage.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.