Have you heard of the latest tariff policy by U.S. President Donald Trump? This massive decision has created massive turbulence in most international markets. But apparently, not K-pop. In the middle of all this uncertainty after the Trump tariff policy, K-pop investment has not become a promising safe haven in 2025, even when the other markets seem to struggle a lot.

But how is that possible? Check out all the reasons behind the thriving future of K-pop, and let us know whether you will eventually join the trend.

K-pop Stocks Skyrockets with Promising Investment

As the global market faces uncertainty due to the new Trump tariff policies, K-pop has unexpectedly emerged as a safe haven investment in 2025. While industries like manufacturing and technology are feeling the pressure of trade disputes, South Korea’s big 4 entertainment companies—HYBE, SM, JYP, and YG Entertainment—are experiencing skyrocketing stock prices.

Previously, we have discussed how 2025 will become yet another glory day for K-pop. Apparently, investors have also been showing similar interest. They’re now looking at K-pop as not just a cultural phenomenon but a smart financial opportunity.

It all started last week when Korea Times reported that shares of K-pop big 4 giants showcased a new breakthrough. This increase was particularly surprising after all the massive controversies and slowdown in artist activities previously resulted in declines in 2024.

According to the Korea Exchange, the latest stock price increases include:

- JYP Entertainment: Up 6.09%, closing at ₩83,600 ($57.5),

- HYBE: Up 3.15%, reaching ₩245,500 ($170.3), marking a new 52-week high for the second consecutive day,

- SM Entertainment: Closing at ₩95,000 ($65.91), approaching its own record high,

- YG Entertainment: Rising 2.09% to ₩53,800 ($37.32).

And apparently, all these numbers mean that investors have increasingly viewed K-pop as a stable and profitable industry, even when global markets is now facing economic turbulence after the Trump tariff policies in 2025.

Why K-pop is Rising in 2025 Even After Trump Tariff Policies

So, why K-pop? Why are investors taking the leap of faith and putting their gold in the baskets belonging to these 4 giants? Well, there are several apparent reasons why these smart investors turn to K-pop amid this global panic.

1. U.S. Tariffs Have Minimal Impact on Entertainment

Firstly, you must understand that the latest Trump tariff policies in 2025 mostly focus on physical goods. It means that the policy will affect industries that rely on imports and exports of real products like steel, electronics, and automobiles. Therefore, these products are more vulnerable to financial losses.

K-pop, on the other hand, operates primarily in digital and intellectual property-based markets, such as music streaming, online content, concerts, and merchandise.

Therefore, unlike electronics or cars, songs, albums, and artist-related content are not affected by trade barriers. This benefit will then allow entertainment companies to continue expanding globally without being weighed down by extra costs.

2. Major Artist Comebacks Driving Growth

Secondly, after a slow period in 2024, some of K-pop’s biggest names will be making highly anticipated returns in 2025. And these promising comebacks result in massive anticipation from both fans and investors.

BTS is expected to resume full-group activities by June, following the members’ military service commitments. With their massive global fanbase, HYBE’s earnings are expected to see a significant boost.

Meanwhile, BLACKPINK is preparing for a new world tour, bringing in revenue from ticket sales, sponsorships, and merchandise.

Moreover, new group debuts are also adding fresh momentum:

- SM Entertainment is launching its first girl group in four years, Hearts2Hearts, on February 24.

- JYP Entertainment debuted its first boy group in seven years, KickFlip, in January.

Along with these promising return, more legendary K-pop acts: G-Dragon, BLACKPINK members Jennie, Jisoo, and Lisa’s solos, GOT7, GFRIEND, and EXO will also attract longtime worldwide fans to K-pop.

The return of these legendary acts, along with the introduction of promising K-pop rookies, will become the crucial key to driving the industry’s future profits.

3. Potential Reopening of the Chinese Market

For years, China was a major market for K-pop. The country has shaped about 20 percent of total entertainment company revenue before 2017. And yet, due to the political tensions that led to restrictions on Korean cultural exports, the number must fall to around 8 percent.

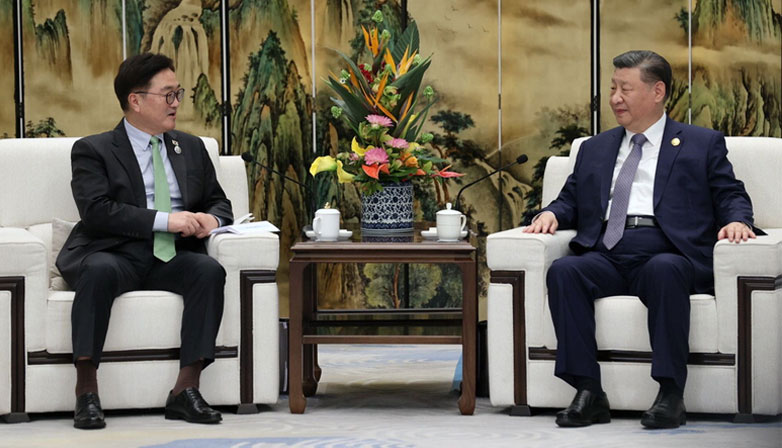

But today, there are signs that China may lift some of these restrictions. During the 2025 Asian Winter Games in Harbin, Korea’s National Assembly Speaker Woo Won Shik met with Chinese President Xi Jinping to discuss cultural exchanges. Xi reportedly expressed interest in resuming stronger cultural ties, which could pave the way for K-pop’s return to China on a larger scale.

Now, if China does decide to ease these restrictions, we will be seeing a massive surge in album sales, concert tours, and merchandise sales.

Institutional Investors Started Buying K-pop Stocks

Furthermore, with the rising trend in the K-pop stock markets, apparently, big investors are also closely observing this situation. And did you know? Since the start of the year, institutional investors have aggressively increased their holdings in K-pop stocks, including:

- HYBE: ₩72.1 billion ($49.20 million),

- SM Entertainment: ₩32.8 billion ($22.40 million),

- JYP Entertainment: ₩29.4 billion ($20.10 million),

- YG Entertainment: ₩2.1 billion ($1.43 million) of net purchases.

According to financial analyst, the entertainment industry, particularly K-pop, is one of the few sectors positioned to grow despite global economic challenges. Therefore, these investors decided to go with K-pop, especially when the industry is expected to make a massive comeback in 2025.

“Entertainment companies are benefiting from strong intellectual property. It means that they are less affected by trade issues.

With major artists returning and China potentially reopening to K-pop, the outlook for the industry is highly positive.”

Ji In Hae, a researcher from Shinhan Investment & Securities.

K-pop: Not Just Music, But Promising Business Investment in 2025

All this time, we only know K-pop for its brilliant music, dazzling performances, and powerful cultural influence. However, the industry will take a dramatic turn this year. With the skyrocketing international demand, powerful fan engagement, and diverse revenue streams, K-pop is now gaining recognition as a serious investment opportunity, especially amid Trump tariff uncertainties in 2025.

As the global markets face economic pressure, entertainment companies are standing out instead as a stable and growing sector. And the above reasons are the strong foundation for why K-pop companies will become a smart choice for investors looking for promising long-term gains.

Finally, do you also believe that K-pop is entering its prime as a safe haven investment in 2025? And as an investor yourself, will you be joining the trend and putting some of your eggs into K-pop’s baskets? Please share your thoughts with us in the comments.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.