For a long time, many people viewed K-pop agencies as typical music companies. They recruit trainees, train them for years, produce songs, and then introduce the groups through a planned debut process. On the surface, nothing has changed: music continues to be released, and fandoms continue to grow. But upon closer inspection, the industry’s trajectory is no longer as simple as it once was. Debuts now serve as instruments in a sustainable business strategy—a way to expand an artist’s portfolio while increasing the chances of producing one or two truly commercially successful groups.

K-pop, A Booming Industry — But Where Is It Going?

Along with this expansion, the number of groups debuting each year continues to rise. Both large agencies and smaller entertainment companies are vying to introduce new idols to an increasingly competitive market. In this crowded landscape, the competition for public attention is increasingly intense.

However, the fundamental question is: does the increasing number of groups enrich the K-pop music landscape, or does it lead to a trend of standardization in concepts and production, thus losing its artistic appeal? To understand this dynamic, we need to delve deeper into the economic logic behind the mass debut phenomenon.

Portfolio Model in the Entertainment Industry

The entertainment industry is inherently hit-driven, characterized by an unequal distribution of profits. Most creative products fail commercially, while only a handful become true blockbusters. Reports suggest a similar situation applies to the K-pop industry, which operates amidst high demand uncertainty and significant investment risks.

This is further exacerbated by structural pressures in the domestic market, ranging from the shrinking school-age population to the fragmentation of consumption patterns driven by digitalization, which continue to erode traditional audience bases. Meanwhile, the number of active groups continues to grow, while idol life cycles are shorter than in previous generations.

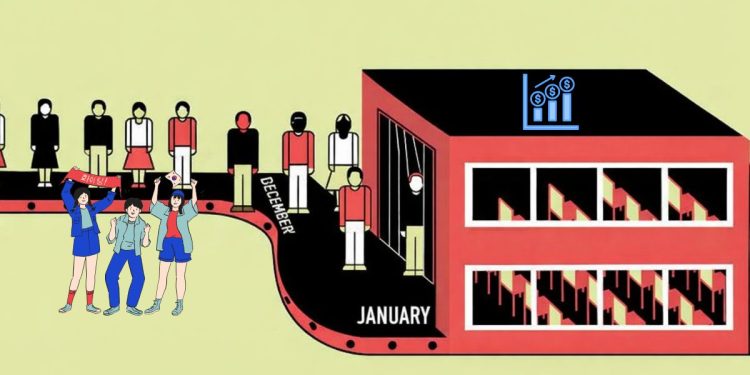

In such conditions, agencies can no longer rely on a single group with a long career as the backbone of their revenue. Increasing competition and a saturated market are pushing companies to work on more projects simultaneously. As a result, debuts are becoming more frequent and more planned as part of a broader growth strategy.

At this point, the portfolio approach becomes relevant. By launching multiple groups simultaneously, agencies increase the likelihood of a single “big hit” that can offset the costs of other, less successful projects. In other words, the rise in debuts is part of a highly calculated risk diversification strategy in an industry full of uncertainty. Experiments like tripleS and virtual idols have emerged as strategic responses to an increasingly competitive market.

The Implications of Over-Debut: Concept Recycling

One of the clearest indications of over-debuting is the weakening of innovation in the K-pop industry, leading to a tendency to follow trends rather than pursue originality. In previous generations, each group had a distinctly different musical style. BIGBANG was known for its exploratory blend of hip-hop and electronic music; 2NE1 cultivated a bold, rebellious image; and EXO introduced sci-fi elements into its identity.

As the number of debuting fruits continues to surge, many newcomers prefer to follow established paths rather than forge their own identities. The girl crush concept, once strongly associated with BLACKPINK, has now been adopted so widely by new girl groups that it has created a uniformity in sound, fashion, and attitude. The same is true for the dark and mysterious concept, often perceived as the hallmark of boy groups like VIXX, but has now been so widely imitated that its shocking power has almost been lost.

Instead of trying to broaden the scope of K-pop music, many agencies choose to play it safe by repeating what has worked before—and that leaves very little room for true creativity to grow.

Is K-Pop Sacrificing Artistic Differentiation?

Ultimately, this question isn’t simply a critique of the sheer number of debuts. It reflects the industry’s long-term direction. When market saturation meets constant growth pressures, quality and innovation risk are marginalized. In the short term, over-debuting may be effective in maintaining revenue streams and global exposure. But in the long term, excessive repetition can erode the uniqueness that once made K-pop a global phenomenon. If artistic differentiation continues to erode, K-pop’s emotional and cultural appeal could weaken. Therefore, the industry’s sustainability depends on how willing agencies are to invest in long-term creative growth.