K-pop is no longer confined to the realm of global culture. It’s a multi-billion-dollar industry. Behind its lavish concerts and massive fan base, the industry operates as a highly competitive market, with dozens of new groups debuting each year. However, this growth hasn’t always been matched by the economic well-being of its players. Rather than creating broader opportunities, expansion has fragmented revenues into an increasingly saturated market in K-pop industry. Revenue previously concentrated in a handful of dominant groups is now split among a growing number of artists, squeezing profitability and posing sustainability challenges for both agencies and idols.

Revenue Shifts and the Growing Sustainability Challenge

The K-pop industry has long been perceived as a symbol of the economic success of South Korea’s creative industries. Global-scale concerts, million-dollar album sales, and a massive fan base are often cited as evidence of K-pop’s continued growth. However, behind this expansion, the industry’s revenue structure is undergoing increasingly complex shifts, leading to shifts in income distribution and increasing challenges to financial sustainability.

Shifting Revenue Distribution

The first thing to highlight here is how, as more entertainment companies enter the industry and the number of up-and-coming artists increases, revenue is being divided among more artists, leading to several financial challenges, such as:

- Fans have limited budgets to support their favorite idols.

- Profitability is lower for medium-sized and small-scale agencies. At the same time, major labels like HYBE, JYP, SM, and YG have the financial backing to sustain their groups, including through multiple comebacks.

- Competition for concert revenue has led to a saturation, with mid-sized and up-and-coming groups having to compete with top-tier groups to sell out large arenas.

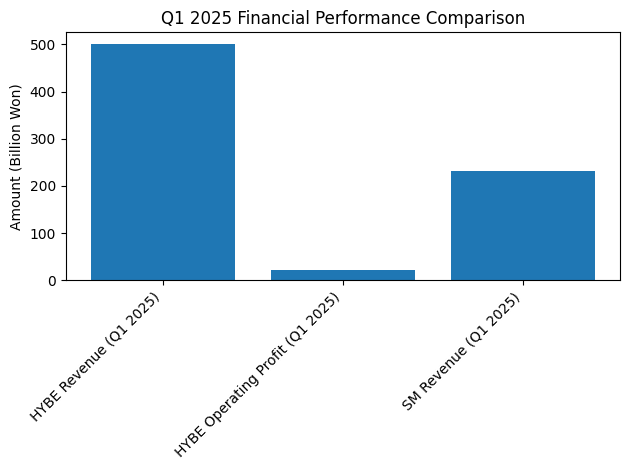

Reports indicate that HYBE recorded revenue of 500.6 billion won and operating profit of 21.6 billion won in the first quarter of 2025, increases of 38.7 percent and 50 percent, respectively, compared to the previous year. SM also recorded growth, with revenue of 231.4 billion won. In contrast, YG and JYP saw their market share shrink despite the popularity of their idols.

At the very least, this shift in revenue distribution confirms two trends:

- The entertainment industry is becoming increasingly concentrated in the hands of dominant players, as evidenced by HYBE’s growing market share, making it increasingly difficult for other companies and smaller agencies to compete and survive.

- Competitive pressures are intensifying, especially for SM, JYP, and YG, whose market share continues to erode. These three companies are under pressure to find new revenue streams while adapting to changing music consumption patterns.

In the future, these market dynamics will also determine the direction of the K-pop industry’s business strategies, from how agencies promote their artists and structure contract agreements to the extent to which they are willing to invest in developing previously unexplored revenue streams.

Financial Sustainability Challenges Facing K-Pop Agencies

Market saturation not only impacts artists but also erodes the financial well-being of entertainment agencies themselves. On the one hand, they must continue to invest in developing new groups. On the other hand, existing groups still require significant attention and management costs. This fuels increasingly fierce competition and forces agencies to boost revenue from their existing artists. Challenges to financial sustainability can be seen in two entities:

Rising Debut Costs and Heightened Financial Risks

Launching a new K-pop group to the market is no small feat. The estimated cost is at $500,000 to $2 million, covering training, production, marketing, and even music video production. According to Naver, Jaejoong revealed that his agency, iNKODE Entertainment, spends 20 billion KRW (approximately $13.7 million USD) annually to manage two idol groups.

With dozens of debuts each year, smaller agencies are particularly vulnerable. If their groups fail to capture the public’s attention, the financial losses they incur can lead to bankruptcy. The overcrowded market makes it increasingly difficult for new groups to build a solid fan base, and this is ultimately one of the main reasons why many groups are forced to disband before they have a chance to thrive.

Concert Revenue Dominated by Top-Tier Groups

As more K-pop groups emerge each year, competition in the concert arena intensifies. New artists must compete for performance space, attract ticket buyers, and even vie for sponsorship deals. Ironically, despite the growing number of groups holding concerts, the real revenue streams remain concentrated in the hands of a handful of big names—those with established fanbases and international recognition.

Concert tours can bring in billions of dollars annually, but over-reliance on this revenue source carries its own risks for agencies.

- High production costs. Holding a concert requires significant expenses, including venue booking, stage design, equipment rental, security personnel, and promotion. If ticket sales don’t meet expectations, the agency may struggle to recoup its initial investment.

- The nature of concert revenue itself is unpredictable. Unlike relatively stable revenue from album sales or digital streaming, concert revenue is highly dependent on the touring schedule.

Quality Over Quantity

K-pop’s strength has always been its ability to constantly evolve, adapting to changing audience tastes while simultaneously setting global trends. However, to continue this journey without losing its way, the industry needs to be more honest about the dangers lurking behind overproduction and the relentless flow of debuts.

The long-term sustainability of K-pop cannot rely solely on popularity and momentum based on quantity. It requires strategic steps that are truly oriented toward stability, such as providing artists with room to grow. If these challenges are successfully addressed, the industry will be able to overcome the current saturation phase and maintain its relevance for decades to come.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.