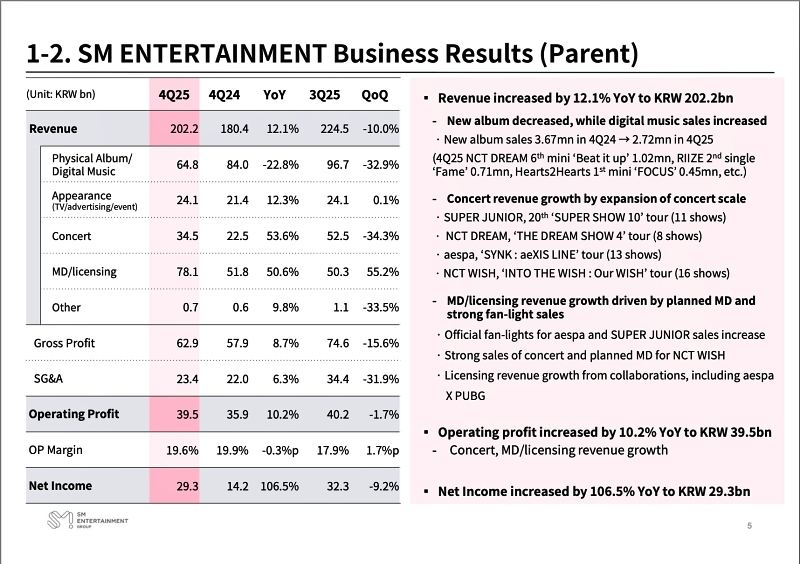

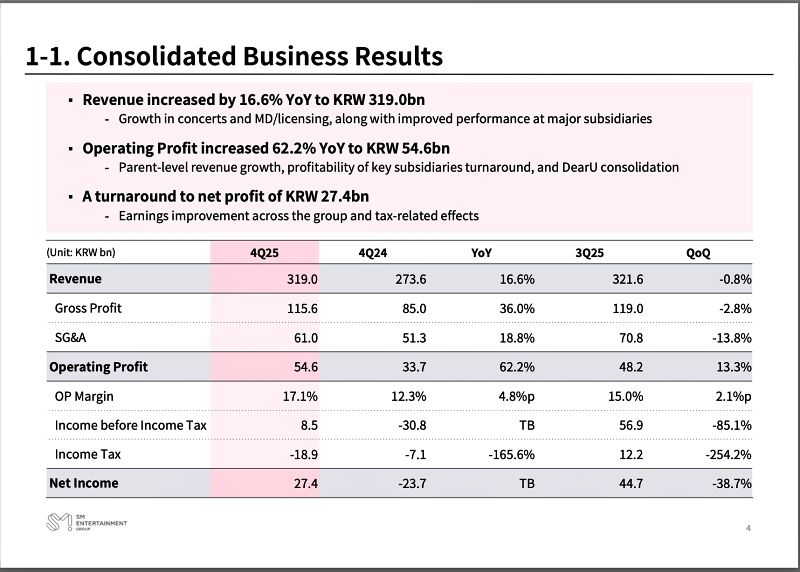

SM Entertainment’s Q4 2025 earnings report reveals a major transformation in how the K-pop business works. While physical album sales declined by 22.8% compared to the previous year, the company’s financial health improved. SM reported KRW 319 billion in revenue and a KRW 54.6 billion increase in operating profit.

This performance tells that the company no longer relies on physical albums to drive its bottom line. Instead, SM is centering on live experiences with the global tours and digital connections as its primary revenue engines.

Concerts & Merch Propel SM Entertainment to Record KRW 319B Revenue in Q4 2025

On February 11, SM Entertainment published its 4Q25 earnings report. The results suggest the K-pop business is no longer driven solely by album sales, but by a broader entertainment model powered by “Live Experience” and “Digital Ecosystems.”

The “Album Fatigue” Phenomenon & Strategic Survival

In the final quarter of 2024, SM successfully sold 3.67 million new albums. By the same period in 2025, that number fell to 2.72 million units. Yet this decline did not translate to lower earnings.

Previously, K-pop fans bought several copies to support their favorite groups on the charts. The 4Q25 data shows that fans now prefer new live experiences instead of collecting albums.

Several factors explain this change in consumer behavior:

- Digital streaming is now the primary way fans listen to music.

- Collectors are becoming more selective with their spending,

- Environmental matters are changing how fans view plastic waste.

Rather than fighting this trend, SM refocused its business strategy on higher-margin revenue streams, shifting from the ‘unboxing’ experience to giving fans real-life moments with the artists.

However, this shift prompts important questions about current music consumption trends. Is the “Album Era” over or just lesser?

Concert Tours Boost Significant Growth

Live performances offer lasting value; they offer new experiences that create memories an album purchase cannot.

As fandom-artist connections grow, SM is focused on providing the best experience for K-pop fans and artists worldwide.

From small theaters to large stadiums, SM extended live performances to give a new live experience for K-pop fans, while also building a solid community and generating substantial revenue beyond ticket sales.

Major global tours by Super Junior, aespa, NCT WISH, and NCT DREAM drew massive concertgoers.

Its subsidiary, Dream Maker, manages global production and venue operations. This vertical integration allows the company to retain greater profit margins.

With this new strategy, the parent company’s concert revenue increased by 53.6% year over year to KRW 34.5 billion.

Merchandise and Licensing Revenue Surge in Q4 2025

This quarter, merchandise and licensing revenue grew 50.6% to KRW 78.1 billion.

Official fan merchandise, including light sticks and limited-edition concert goods, contributed to this increase. Strategic partnerships, such as aespa’s collaboration with gaming platform PUBG, expanded revenue into digital markets and younger demographics.

Digital Platforms Provide Steady Income

As fandom-artist connection trends change, fans seek daily interaction with their idols. Besides focusing on content, SM Entertainment also offers “Bubble” to facilitate fan engagement.

SM’s messaging app Bubble, operated through its subsidiary DearU, derives revenue through monthly subscriptions. The platform requires minimal operating costs while delivering a constant monthly income, regardless of the artists’ activities.

Digital services have low overhead. Unlike physical goods, they require no shipping or warehousing. For SM, digital messaging is highly profitable.

This approach delivers an alternative communication channel to competitor HYBE’s digital platform, Weverse.

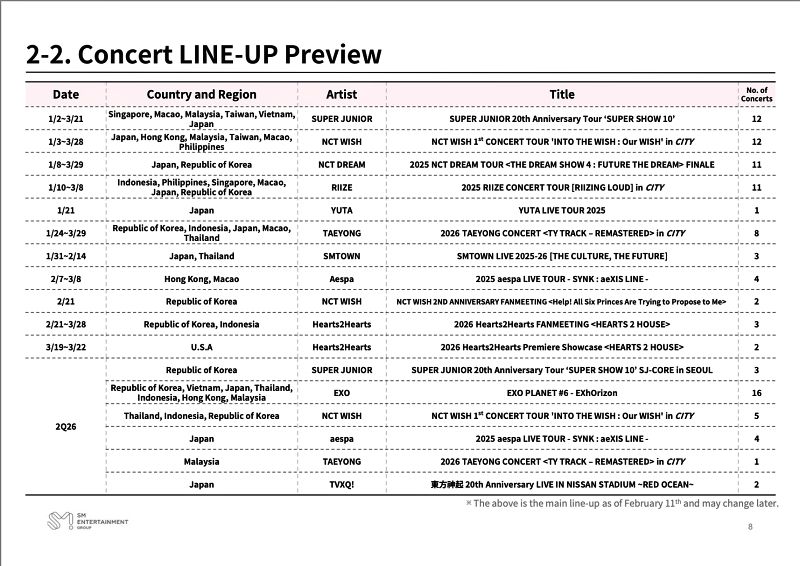

2026 Touring Schedule to Maintain Momentum

SM Entertainment’s artists will embark on a 2026 tour to maintain fan engagement. They are EXO, TVXQ!, NCT WISH, RIIZE, Hearts2Hearts, and TAEYONG.

This schedule secures consistent revenue generation throughout the year.

SM NEXT 3.0: Strategic Restructuring

According to Co-CEO Young Jun Tak, SM’s new strategy, SM NEXT 3.0, has two key elements. Those are building and strengthening the production organization and the status of the company’s new IP pipeline.

He stated,

We believe that maintaining a balance between growth, profitability, and long-term IP competitiveness is more important than ever. Our multi-creative system under SM NEXT 3.0 was designed based on this recognition.”

CEO Cheol-hyuk Jang outlined the company’s strategic shift from “speed-driven growth” to a “sustainable growth structure” through three pillars. Those are Multi-Creative System, Strategic Global Partnerships, and AI and IP Expansion.

He conveyed,

“Rather than applying a uniform expansion strategy across all regions, we are pursuing a more segmented approach—leveraging strategic partnerships and tailoring our expansion by IP characteristics and local market conditions. By utilizing our partners’ networks and local expertise, we aim to respond more flexibly to changing market environments while efficiently distributing risks and resources.”

For the company’s global expansion strategy and AI-driven technology advancement, CEO Cheol-hyuk Jang explained,

“AI-based technology strategy is another key pillar of SM NEXT 3.0. AI is not intended to replace creativity, but to serve as a tool to enhance production efficiency and decision-making. By applying AI across the content production process, we aim to reduce time and costs, while using data analysis to deepen our understanding of fans and markets, enabling more sophisticated decision-making. We plan to gradually expand AI utilization across our business, always guided by its contribution to strengthening our core competencies.”

The Bottom Line

The fourth-quarter 2025 earnings report showcases the outcomes of SM Entertainment’s new business model strategy, which shifted from album sales to fan engagement through concerts and digital services.

By diversifying its revenue through concerts, subscription services, and gaming partnerships, the company sustains profit growth despite declining album sales.

This strategy focuses on depth over volume, protecting the company from the unavoidable decline in physical products while adjusting to changing consumer behavior.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.