Netflix has experienced a significant revenue surge over the past three years, with Korean content being one of the key drivers behind this growth. From record-breaking dramas like “Squid Game” to innovative animated hits like “KPop Demon Hunters”, Korean IP has transformed from a regional specialty into a core global growth engine for the streaming giant.

This article breaks down Netflix financial performance from 2023 to 2025 (so far). It shows how Korean content is not only gaining viewers but also generating real revenue and business value on Netflix.

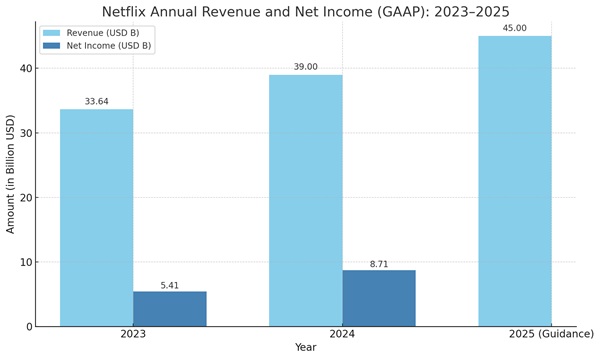

Netflix Revenue & Profit: 2023–2025

Netflix financial results show steady acceleration. In 2023, Netflix generated $33.64 billion in revenue with $5.41 billion in net income. That growth accelerated sharply in 2024, with revenue increasing to $39.00 billion and income rising to $8.71 billion. For 2025, the company projects revenue between $44.8 billion and $ 45.2 billion.

| Year | Revenue (USD B) | Net Income (USD B) |

| 2023 | $33.64 | $5.41 |

| 2024 | $39.00 | $8.71 |

| 2025 (est.) | $44.8–45.2 | TBD (margin ~30%) |

This growth on Netflix is driven not only by higher subscription fees and ad-tier models but also by strong performance from international content—especially Korean content.

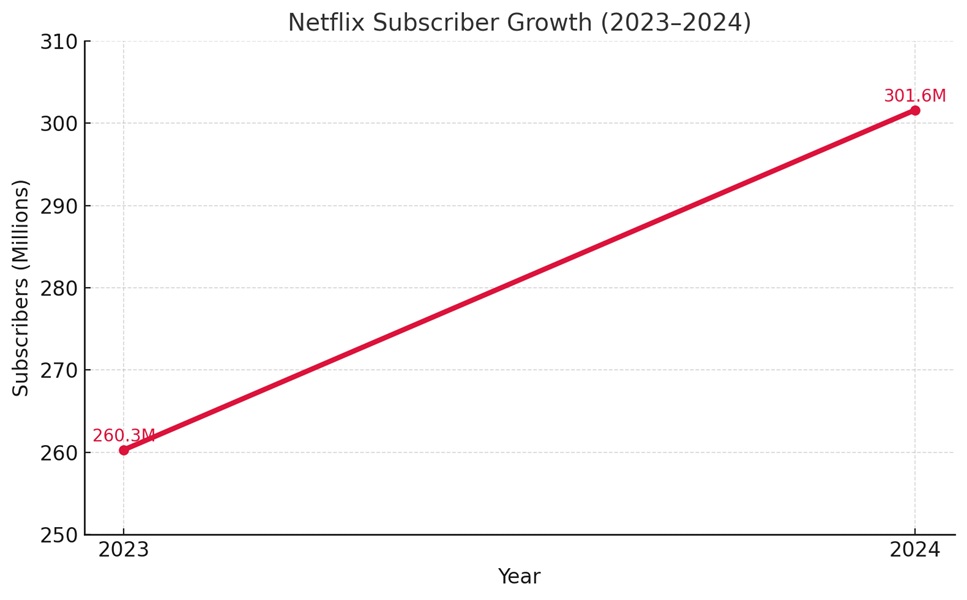

Subscriber Growth: Fueled by Korean Storytelling

Between 2023 and 2024, Netflix gained over 41 million new subscribers, increasing its paid user base from 260.3 million to 301.6 million.

Much of that engagement is linked to Korean content:

- Over 60% of Netflix’s total global members have watched at least one Korean show.

- Korean content consistently ranks as the #1 non-English genre on Netflix by watch time (8.71% of global hours in early 2024).

- Since Squid Game launched in 2021, analysts estimate that over $3.4 billion in subscriber revenue has been influenced by Korean IP.

Looking ahead, Netflix is estimated to reach approximately 325 million subscribers by the end of 2025. This continued growth is primarily driven by the global appeal of Korean content and strategic investments in international programming.

Korean Titles Driving Growth

| Title | Views (First Month) | Global Reach | Business Impact |

| Squid Game S2 | 60.1M (3 days) | #1 in 93 countries | Drove subscriptions, cultural brand halo |

| KPop Demon Hunters | 106M (5 weeks) | Top 10 in 93 | Boosted animation and music engagement across platforms |

| All of Us Are Dead | ~100M+ (2022-23) | #1 in 25+ countries | Expanded horror genre global audience |

“Squid Game” Series

- Most-watched series in Netflix history.

- 142 million households watched Season 1 within 28 days.

- Season 2 (December 2024) debuted at #1 in 93 countries, garnering 487.6 million hours watched during premiere week.

- Season 3 (June 27, 2025), the final season, garnered 60.1 million views in its first 3 days (the biggest 3‑day launch ever on Netflix), totaling 368.4 million hours viewed.

“All of Us Are Dead” and “Hellbound”

- Contributed to Netflix’s dominance in the zombie and horror genres.

- Strong performance in both Asia and Latin America.

“KPop Demon Hunters”

- Netflix’s breakout animated musical action.

- 106+ million views in five weeks.

- Ranked #1 in 26 countries, Top 10 in 93.

- Soundtrack debuted at #3 on Billboard 200, with 168,000+ album units sold and 96 million Spotify streams in a week.

- Boosted Netflix Q2 2025 performance, where revenue topped $11 billion.

“KPop Demon Hunters broke Netflix records for animation and redefined how musical content can drive fan engagement,”

Netflix Q2 2025 commentary.

Soundtrack Revenue: A New Monetization Stream

KPop Demon Hunters is also notable for creating a revenue ripple effect through music:

- “Golden” (by virtual K-pop group Huntrix) reached #1 on the U.S. Spotify charts.

- Soundtrack success opens merchandising, licensing, and live performance opportunities.

This type of vertical integration may signal a new monetization strategy for Netflix, allowing IP to expand into other industries (such as music, fashion, and games).

Conclusion: Korean Content = Netflix Global Revenue Engine

From “Squid Game” to “KPop Demon Hunters”, Korean content has become a cornerstone of Netflix international strategy. It drives subscriber acquisition, cultural relevance, brand value, and new monetization streams (soundtrack sales, merch, engagement).

As Netflix continues investing $2.5 billion in Korean content through 2027, expect more record-breaking IP that delivers not just views—but real business value.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.

Korean content is booming louder