The dispute between SM Entertainment and its founding father Lee Soo Man is getting fiercer and worse. Even after HYBE was expected to enter as the white knight, the fight between SM Entertainment and Lee Soo Man does not seem to end soon. So, what happened to SM Entertainment and Lee So Man? And does HYBE really own SM Entertainment now? Check out the following complete stories and discussions.

SM Entertainment to Face Possible Legal Actions from Founder Lee Soo Man

SM Entertainment and Lee Soo Man are currently under one of the greatest disputes in the Korean Entertainment industry. After announcing plans of contract termination with Lee Soo Man and various attempts to acquire his shares, SM Entertainment is now facing a possible lawsuit from its own founding father.

TV Daily reported a few days ago that Lee Soo Man was planning to take legal action against SM Entertainment. According to the report, the recent act of Kakao Entertainment purchasing 9.05% of SM Entertainment’s shares was considered illegal. Lee Soo Man’s legal representative added that the purchase occurred without Lee Soo Man’s knowing as an attempt to shake the company’s management’s rights.

“It is illegal to issue new shares or convertible bonds to a third party to shake the influence in the company’s management, including management rights or defense of control rights, in a dispute over management rights of the company.

Such action violates the stockholders’ right to subscribe to new shares.”

Hwawoo, Lee Soo Man’s legal representative.

What Happened to SM Entertainment and Lee Soo Man: Massive Dispute Between “Father and Child”

So, what happened to SM Entertainment and Lee Soo Man, really?

On February 7, Lee Soo Man’s legal representative, Hwawoo Law Firm, released an official statement regarding what happened to SM Entertainment and Lee Soo Man. According to their statement, there has been a management dispute between Lee Soo Man, the founding father and largest shareholder of SM Entertainment, and Align Partners.

Align Partners is a shareholder activist fund that commonly takes profits by investing in underperforming companies (also known as Private Equity Fund). Indeed, it is mostly similar to what Miracle Investment did in Song Joong Ki’s Reborn Rich Korean drama.

The difference is that as a private equity fund, companies like SM Entertainment are simply businesses for them. Disregarding the company’s value and origins, they buy it at its lowest value, improve its performance using any means necessary, and resell the company when the shares are high. Then, they move to the next underperforming company.

Last year, Align Partners submitted several proposals to appoint an auditor for SM Entertainment’s regular shareholder meetings. Since then, SM Entertainment has undergone various attempts and disputes over Lee Soo Man’s management rights. The company even requested access to SM Entertainment’s accounting books and board meeting notes.

A Stab in the Back

The worst about what happened to SM Entertainment and Lee Soo Man is that the dispute originated from a stab in the back by Lee Soo Man’s own family member.

Hwawoo Law Firm reported that previously on January 20, co-CEO and Lee Soo Man’s nephew Lee Sung Soo allegedly backstabbed Lee Soo Man by approving Align Partners’ proposal. Lee Sung Soo did it with another co-CEO, Tak Young Joon, without even consulting with Lee Soo Man as the largest shareholder of SM Entertainment.

Lee Sung Soo and Tak Young Joon elevated the tensions between SM Entertainment board of directors and largest shareholder Lee Soo Man. Together, they went against Lee Soo Man and unilaterally distributed new shares as well as convertible bonds to a third party, Kakao Entertainment. And they did it to expand their influence and secure control of SM Entertainment.

“As the legal firm of the largest shareholder, we will block SM Entertainment’s board of directors’ attempts at this through an injunction, banning the issuance of new shares and convertible bonds, and we will hold the directors responsible for this both civilly and criminally liable.”

Hwawoo Law Firm.

HYBE to Possibly Enter the Dispute as The White Knight

Following the fierce family dispute between SM Entertainment and Lee Soo Man, Kpop giant behemoth HYBE is reportedly seeking to enter as the white knight.

On February 9, HYBE confirmed their plans involving tender offers and acquisitions of SM Entertainment shares.

“We continuously review matters related to the acquisition of shares, such as the tender offer for SM Entertainment’s shares. However, nothing has been confirmed yet. We will announce and redisclose specific details regarding this decision in the future, approximately within a month.”

HYBE

Previously, rumors circulated that HYBE had been moving in the background with various tender offers to SM Entertainment. Through a large domestic company, HYBE offered to buy SM Entertainment’s shares at between 110,000 to 120,000 KRW per share. And if this offer is successful, it means that HYBE would secure SM Entertainment’s management rights (co-management), with Lee Soo Man.

This is the alleged reason why SM Entertainment held an emergency board meeting on February 7. A meeting that resulted in Kakao’s acquisition.

The interpreted reason was that if Lee Soo Man managed to bring in a partner who would further grow SM Entertainment while allowing him to still participate in managing the company, Lee Soo Man would be able to persuade shareholders to support him. And there is no better partner than HYBE, a company that managed to raise global artists, BTS.

What Happened to SM Entertainment and Lee Soo Man Results: HYBE is Now the LARGEST Shareholder

Finally, reports stated that what happened to SM Entertainment and Lee Soo Man power struggle would trigger a massive competition between HYBE and Kakao. But at last, HYBE came out as the winner.

On February 10, Hankyung exclusively reported that HYBE had offered to buy 14.8% of Lee Soo Man’s shares in SM Entertainment at a premium price of 120,000 KRW. Moreover, HYBE also planned to secure a total of 25% of SM Entertainment shares at the same price.

Indeed, Lee Soo Man previously refused to sell his shares to his biggest rival. However, Lee Soo Man was losing his power in SM Entertainment. Therefore, he turned to HYBE and sold his shares with premium offers.

And apparently, HYBE accepted the offer.

Immediately after the plans circulated, HYBE signed a contract to acquire 14.8% of Lee Soo Man shares in SM Entertainment. As of February 10, HYBE is now the largest shareholder of SM Entertainment.

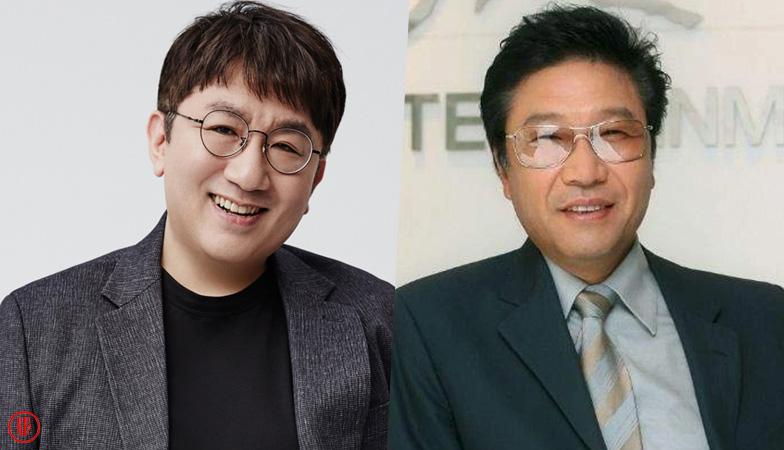

As it was previously reported, Lee Soo Man had formed a consensus with Chairman Bang Si Hyuk to expand their global business together.

“HYBE fully agrees with Lee’s strategic initiatives including metaverse, a multi-label system and the sustainable vision campaign. Leveraging our capabilities and resources, HYBE will further strengthen the presence of K-pop in the global stage and focus on improving SM Entertainment’s corporate governance.”

Bang Si Hyuk, HYBE Chairman.

Greatest Collab in Kpop History!

February 10 marks the end of the long rivalry between the two Kpop founding fathers, turning them into the most fantastic collab in history of Kpop.

But the question is: what will happen to SM Entertainment and Kakao artists? Stay with Kpoppost Facebook, Twitter, Instagram, and Telegram channel for more updates.

More to read about Kpop and Kdrama:

- Bae In Hyuk Joins Lee Se Young for New Romance Drama Based on Webtoon

- 20+ Most Iconic Kpop Covers We Should Watch Together

- Im Si Wan Appointed as Ambassador for World Table Tennis Championships 2024

- 7 New Korean Dramas to Watch in February 2023

- Crash Course in Romance Tops Most Buzzworthy Drama for Third Week

<3