If you’ve followed K-pop over the years, you’ve probably noticed how the industry has built its empires on a high-risk formula. It’s a high-risk system with the potential for high returns, yet many groups never break even. However, a wave of reengineering is currently reshaping these traditional business models by applying “Lean Startup” principles in K-pop industry. Companies like ModHaus, which shelters tripleS, are marking a shift towards a more adaptive K-pop business model.

Come along on our journey to uncover the latest innovation strategies in the Korean entertainment industry.

K-pop is Moving from “Blockbuster Risk” to “Lean Startup” Principles

As digital markets become more volatile and consumer preferences shift rapidly, this high-risk model, or “Blockbuster Risk,” is exposing its structural weaknesses. In response, new approaches are emerging. Borrowing principles from the lean startup framework, some K-pop agencies are rethinking how their ideal groups will launch in the global market.

Betting Big: The Traditional “Blockbuster” Model

The term “Blockbuster Risk”refers to a business strategy that relies on large upfront investments with the expectation of generating significant profits if the project is successful. It is commonly used in the Hollywood film industry and has subsequently been adopted in the K-pop production system.

Well, here’s the introduction.

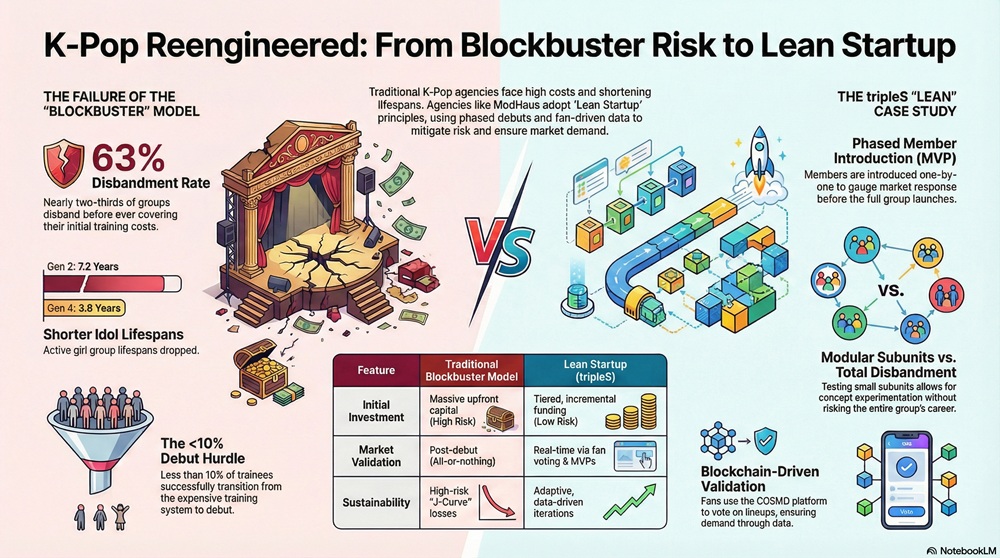

In the 4th Generation era, specifically in the 2020s, the K-pop industry has shown signs of an anomaly. Idol lifespans have become shorter compared to previous generations. One article stated that the average active lifespan of girl groups has decreased from 7.2 years in the 2nd Generation to just 3.8 years in the 4th Generation. The oversupply of groups and the reliance on core fandoms have made career sustainability increasingly unstable.

At the same time, the trainee system continues to operate with the same old pattern: years of expensive training in vocals, dance, foreign languages, and image and branding development. The debut process is carried out all at once with a perfect concept.

Consequently, high initial costs are incurred while revenues are unstable, creating a J-curve effect: losses first, then profits if successful. However, reality shows a high risk. One article from Kcontent Hub stated that the proportion of trainees who debut is very low, at less than 10%. Approximately 63% of groups disband before they can cover their training costs.

These fundamental issues are not simply inefficient. Furthermore, the issue is deeply rooted in the way the idol training and management system is designed. Training programs are indeed designed to teach technical skills, stage presence, and mental toughness. Nevertheless, the success of these programs depends largely on how companies balance their business goals with the physical and mental well-being of the trainees. Therefore, this issue needs to be reconsidered.

Lean Startup: A Strategic Alternative

Eric Ries introduced the concept of the “Lean Startup” as a risk mitigation strategy in an uncertain business climate. Unlike conventional models that require significant initial capital, this approach prioritizes confirming market demand through a series of tiered trials.

The lean startup framework rests on several pillars:

- Minimum Viable Product (MVP) — delivering a product prototype with essential functionality to gauge initial market reaction.

- Build–Measure–Learn — a product development cycle, evaluating consumer response, and then extracting lessons learned for subsequent iterations.

- Data-driven iteration and pivoting — adjusting or reorienting strategy based on the results of metrics analysis.

- Validation before major investments — confirming market demand before committing full resources.

- Incremental experimentation to mitigate risk — distributing risk through structured, ongoing testing.

When applied to the K-pop industry, this approach involves testing artistic concepts, personnel composition, and audience reception before a group’s launch. ModHaus implemented this approach through its tripleS initiative.

Lean Startup in Practice: The Case of tripleS

The “Lean Startup” approach within tripleS is evident in the way the group was built incrementally, rather than with a big debut all at once.

1. Phased Member Introduction as MVP

Instead of introducing all 24 members simultaneously, ModHaus released them one by one (S1–S24). This strategy functioned as an MVP, with each member serving as an initial product tested for market response before moving on to the next phase. This phased approach had two main benefits: minimizing potential risk and ensuring future decisions were based on market feedback.

2. Modular Subunits as Market Experiments

The members are grouped into various subunits with different concepts. The goal is to test which combination resonates best with fans. If one concept isn’t successful, they can try another format without having to disband the entire group.

3. Fan Voting as Demand Validation

Fans participated in determining the subunit lineup through digital voting. The subunit lineup, called Dimension, included early projects like tripleS Acid Angels from Asia (AAA) and + (KR)ystal Eyes (KRE), followed by LOVElution, EVOlution, and later lineups (Visionary Vision (VV), Hachi (∞), and msnz—an acronym for Moon. Sun.Neptune.Zenith, also known as MiSoNyoZ).

All of this was determined through a fan-voting system called Gravity, which runs on COSMO, a blockchain-based governance platform.

Toward a More Adaptive K-pop Industry

While modular systems are nothing new in K-pop, as seen in AKB48’s rotation model and the subunit strategies of Super Junior, NCT, After School, and EXO, ModHaus implements them with deeper integration. Unlike previous approaches that primarily focused on brand expansion, tripleS combines modularity with technology-driven market validation.

This reflects a shift from high-risk speculation to data-driven innovation. Rather than concentrating risk on a single large-scale debut, the lean startup model allows for incremental testing and strategic adjustments based on actual audience response. As a result, K-pop becomes more adaptable to the unpredictable digital market.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.